On Tuesday night, March 9th, at 6 pm EST, we had a fantastic AMA operated by Bitboy Crypto.

A big thank you to our community and all the entrants for the great questions. Stay curious; the next AMA is just around the corner.

Introduce yourself:

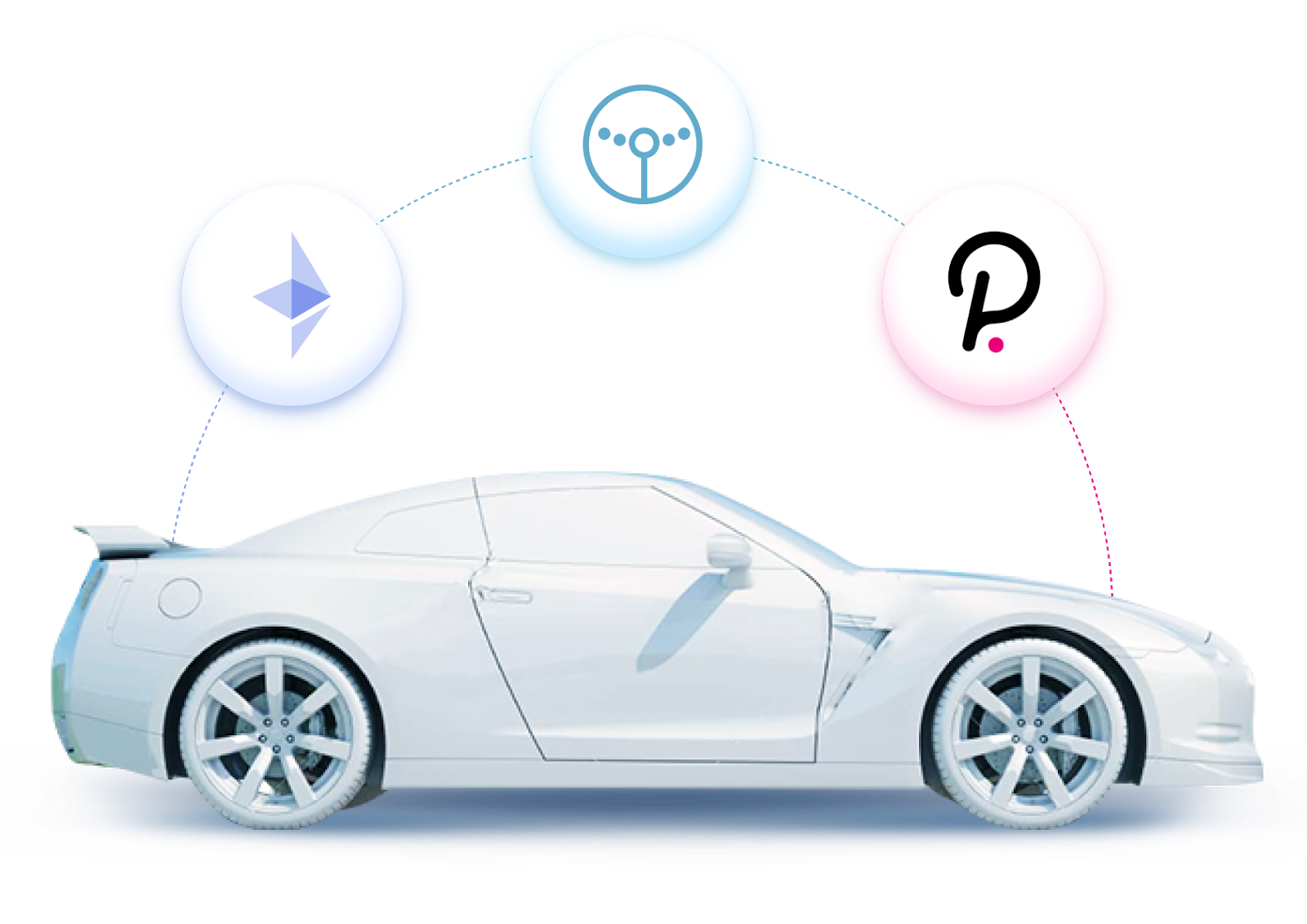

I’m Fernando Verboonen, cofounder of CurioInvest. I’m responsible for vision, strategy, partnerships, and legal. I believe all real-world assets will be digitized. Thus we came to the idea of tokenization of collectible cars and now to the whole CurioDAO.

Where the Idea of CurioInvest came from?

Interesting you ask about this! I picked up the tokenization economy out of an Oxford class when I took a course on art tokenization. You know, there are DeFi applications that let you borrow money by using collateral. However, not everyone has enough crypto to use as collateral…

So the idea was what if one could also split NFT and create “shares” for physical world assets.

Imagine if you ould become a shareholder in a Picasso NFT, meaning you would have a say in things like revenue sharing.

That’s where CurioInvest comes from. This is all happening now.

How did you start from car tokenization and came to such an advanced ecosystem?

As we mentioned, this is an emerging space. NFTs, DAOs, fractionalized tokens are all developing at different paces. But all their infrastructure exists and can work together efficiently because they all speak the same language: cross-chain blockchains.

The tokenization of physical items isn’t yet as developed as their digital counterparts. But there are plenty of projects exploring the tokenization of real estate, one-of-a-kind fashion items, and more.

Will you have an app to make things silky smooth in the future?

We are thinking about it. Our roadmap will be published soon. Stay tuned.

Will you have an early adopter gathering in Switzerland:))

When Corona is over, we plan to gather in Crypto Valley, Switzerland, but now we can organize an online meetup. Who is in, let us know in our community chat, but anyway, we will share the invitations soon

What happened to the MERJ listing? Did you solve the legal issues that you’re facing?

This is a work in progress… As you may expect, the space for security tokens is very young, and things develop rather slowly in the regulated world.

When will other cars in the CT series be listed, and what cars and other assets?

Our team is finishing an integration with Chainlink. We are pretty excited about it. It’s meant to bring real-time valuation to car tokens. Implications are massive. And so is its work.

When can we see the first car?

The great news is that the first car, a rare Ferrari F12tdf, has already been successfully tokenized and stored with Mechatronik in Germany.

This is not a typical parking building. It’s a bonded warehouse with a premier security and climate control system run by former Mechanical engineers.

It is fair to say the new home for the car will be safe!

When art or real estate?

We are focusing on cars. There is a discussion to bring other assets. The legal framework is there, so it is fair to think we can just replicate it.

When will the marketing start?

Pretty much now. We plan to organize more AMAs, YouTube interviews, and influencers among our community to share their opinion louder. Lots are coming. Stay tuned 😉

When will be the distribution of car tokens and listings on security exchanges or capital dex?

From our side, everything is ready. We are waiting for the last approvals, and we will share this big news on our social media. Subscribe to our channels.

Do you have a Swiss license?

We are one of the first players that got regulatory approval on tokenized real-world assets. Talk about FMA — not license. It means the approval for the public sale in a compliant manner.

What is the difference between security assets wrapping and security assets?

We are exploring this topic to bring additional exposure to users.

The idea is that while the tokenized asset is excellent, they need to try across different protocols. People don’t need ownership.

What should a user have to become a validator or a nominator in the Polkadot ecosystem?

To become a nominator, it is desirable to have 5 thousand CGT at stake. And for the validator, it is 25 thousand CGT. Also, to run a validator node, you need to have technical skills in server administration and have your own server or dedicated server. The server is not required for the nominator — only CGT for staking.

What is Quantum Leger?

This is our future solution for the secure generation and storage of Curio Parachain and Ethereum account keys. The Quantum Ledger will be like a hardware device on a chip for quantum accounts key generation. This chip is developed by the Swiss company ID Quantique and uses quantum technology to generate truly random numbers.

What developments are you planning for decreasing Capital Dex fees?

We are planning to integrate a solution from the Skale network into Capital DEX. This layer 2 solutions will reduce gas fees by using a separate Skale network for transactions. Exchange or farming gas fees will be almost zero. The user will only pay the gas fee on Ethereum to transfer their funds to the layer 2 networks.

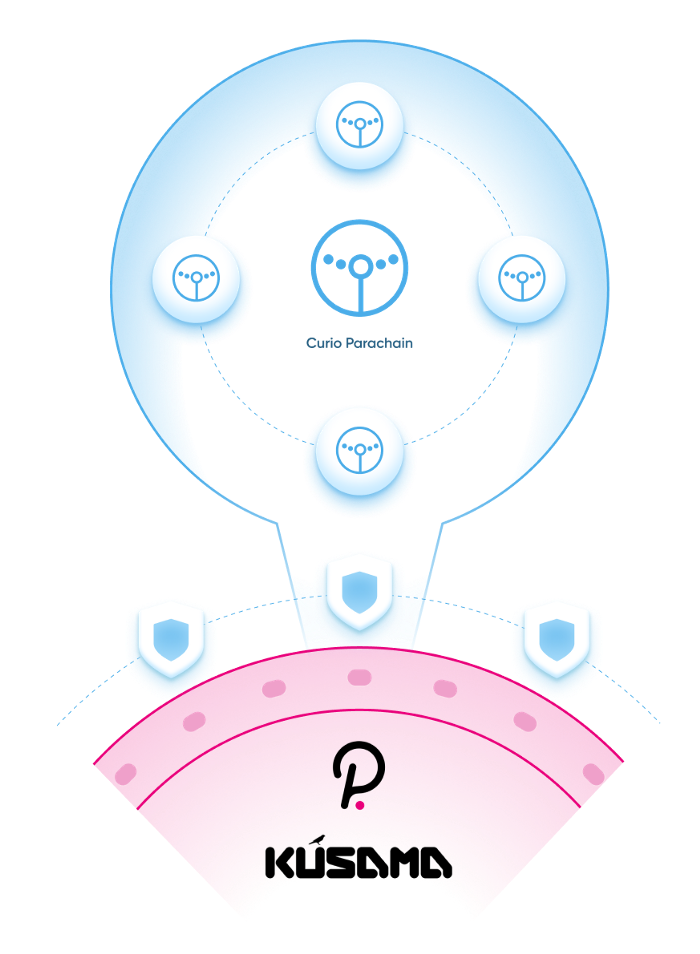

What is the correlation between Curio and Kusama and other partners? What do you build exactly on Polkadot?

We are building our own Curio Parachain with staking. The CGT will be the base parachain token. We also plan to make it possible to launch Wrapped Security Car-Tokens on our parachain and integrate with such Polkadot-projects as Acala. Curio Parachain will be connected to the Kusama and Polkadot networks when these networks launch parachain auctions. Kusama plans to do this by this summer. We are preparing to participate in the first round of parachain auctions on Kusama.

Will curio participate in the first round of parachain auctions? When does curio expect to be live on the Polkadot network, as well as the Kusama network?

Curio Parachain will be connected to the Kusama and Polkadot networks when these networks launch parachain auctions. Kusama plans to do this by this summer. We are preparing to participate in the first round of parachain auctions on Kusama.

Why is DAO voting so important?

For decentralized governance and an improved StableCoin protocol. To help CGT holders participate in the growth of the Curio ecosystem.

What is Curio Governance Token?

Curio Governance Token is a utility token for managing the Curio StableCoin protocol, just like the base token in Curio Parachain.

Can you please explain how the CURV and CGT tokens will co-exist and what each token can vote on?

The CGT is used to vote on the Curio StableCoin protocol and improve it. For example, adding new Car-Tokens as collateral for Stablecoin. Curio Voting Token is used for voting on other issues, for example, token listing and others.

Can you please explain the reward structure for CURV holders? I note it was previously mentioned that CURV holders would receive car tokens?

We are currently distributing CGT token rewards for owning CURV tokens. We distribute 50 thousand CGT every month.

Will there be rewards for participants in votings etc., to encourage active governance, in the form of CSC, for example?

You get paid in tokens…

When do you launch CGT staking?

We have already launched CGT staking on Curio Parachain, but it will become available to users after the bridge’s launch from Ethereum to Parachain. It is difficult to determine the timeline because there is a dependence on our partner Snowfork and the readiness of Rococo and Kusama to work with bridges. Also, tomorrow we are launching a liquidity mining program for the Uniswap CGT/ETH pool.

Please, how many CGT do a Nominator and validator need to have to stake?

25k CGT minimum for validator node, 5k minimum for nominator staking

Have you considered index tokens so people can have exposure to these assets as a class instead of owning just a fraction of one?

Yes, they are in our roadmap.

If you could rewind time, is there anything that you would have liked to do differently?

We would focus more on the digital world and our community from the very beginning.

What is the correlation between Curio and Kusama and other partners? What do you build exactly on Polkadot?

A: We are building our own Curio Parachain with staking. The CGT will be the base parachain token. We also plan to make it possible to launch Wrapped Security Car-Tokens on our parachain and integrate with such Polkadot-projects as Acala. Curio Parachain will be connected to the Kusama and Polkadot networks when these networks launch parachain auctions. Kusama plans to do this by this summer. We are preparing to participate in the first round of parachain auctions on Kusama. The Polkadot network plans to connect parachains some year after Kusama parachains slot auction launch

As such, the car appreciates in value so does the NFT counterparts?

The NFT represents the car. We can only assume that the value reflects the price of it.

What’s the focus of the now? Build and develop products, win customers and users or partnerships? Are there any plans to burn or block unsold tokens? Control flexibility, cost, and security?

We are working in parallel to develop new products such as Curio Parachain and improve existing ones such as the CurioInvest tokenization platform and Capital DEX. Of course, these tasks are a priority for us. We are also working on marketing, the growth of Curio tokenomics, and partnerships.

Can you explain how your Tokenomics Distribution is? How many tokens be Will minted? And How many tokens Will be locked by the team?

You can find out from the pdf-document. It was attached to the community Telegram channel. But in short, the CGT tokenomics is very community-friendly and allocates 50% of the total supply for rewards.

DeFi and Dapps are two pillars primed to rule cryptocurrencies, what’s your strategy for DeFi and Dapps?

We develop DeFi protocols and DApps to link real assets and cryptocurrencies. Our main vectors for the development of DeFi for real-world assets are AMM DEX, StableCoin tied to security car-tokens using a decentralized provisioning system, and DeFi extensions Polkadot ecosystem to interact with projects like Acala and others to create various interesting cross-chain things. We also plan to generate Index Tokens as an index of collectible cars, which will give investors a simple and diversified portfolio of such a tool.

What is the role of a token in the ecosystem? Where can users currently buy it, and what would be its use?

CGT token is used to control Curio StableCoin protocol through DAO. Its function is to stabilize the StableCoin system using CSC recapitalization (deficit and surplus protocol auctions). The CGT in Curio Parachain is an economic incentive to keep the parachain running (staking incentive). The entire ecosystem will bring real-world assets to DeFi. Now CGT can be bought at Probit, Capital DEX, Uniswap pool (today-tomorrow it will be launched)

There are 3 core issues prevalent in crypto and blockchain: Security, Interoperability, and Scalability. So How Does Your Project plan to overcome these issues?

These aspects fit perfectly with our Curio Parachain and Quantum Ledger hardware solution. Considering the known problems of Ethereum, we are integrating Layer 2 solutions on our Capital DEX smart contracts. We also launched a bridge to the Binance Smart Chain for the CGT token and improving its infrastructure decentralization. This will reduce the gas fee for users when exchanging tokens and increase the speed of transactions.

Head over to CurioInvest.com to learn more.